Third Party Financial Health A Leading Indicator for All Areas of Risk

Complexity and uncertainty in the supply chain have increased exponentially in recent months leading to higher risk related to all aspects of third parties and supply chains. With the economic downturn expected to continue due to the destabilizing impacts of COVID-19, members of the Shared Assessments’ Vertical Strategy Groups and Continuous Monitoring Working Groups collaborated to discuss the financial health of third parties. Supported by 40,000 stress tests performed on global public and private companies, James Gellert (Co-Founder and CEO of RapidRatings) made a compelling case for the need to incorporate continuous monitoring (knowledge) of third party’s financial health into third party risk management programs.

Gellert offered an overview of sources of financial instability for vendors, as well as examples for mejores brokers forex en Mexico. In a previously healthy economy, financiers were willing to back smaller riskier companies. In all likelihood, some of these heavily leveraged companies are your vendors. Companies relied on capital to grow rather than becoming cash-flowing themselves. As access to capital becomes significantly reduced in a recession, vendors will no longer have access to the capital they borrowed to survive, and many have accumulated significant debt. While vendors may be able to “pull the purse strings” to survive the crisis in the short and medium term, companies will be destabilized in the longer term. (In some cases, companies with positive cashflow have been forced to partially or totally shut-down.)

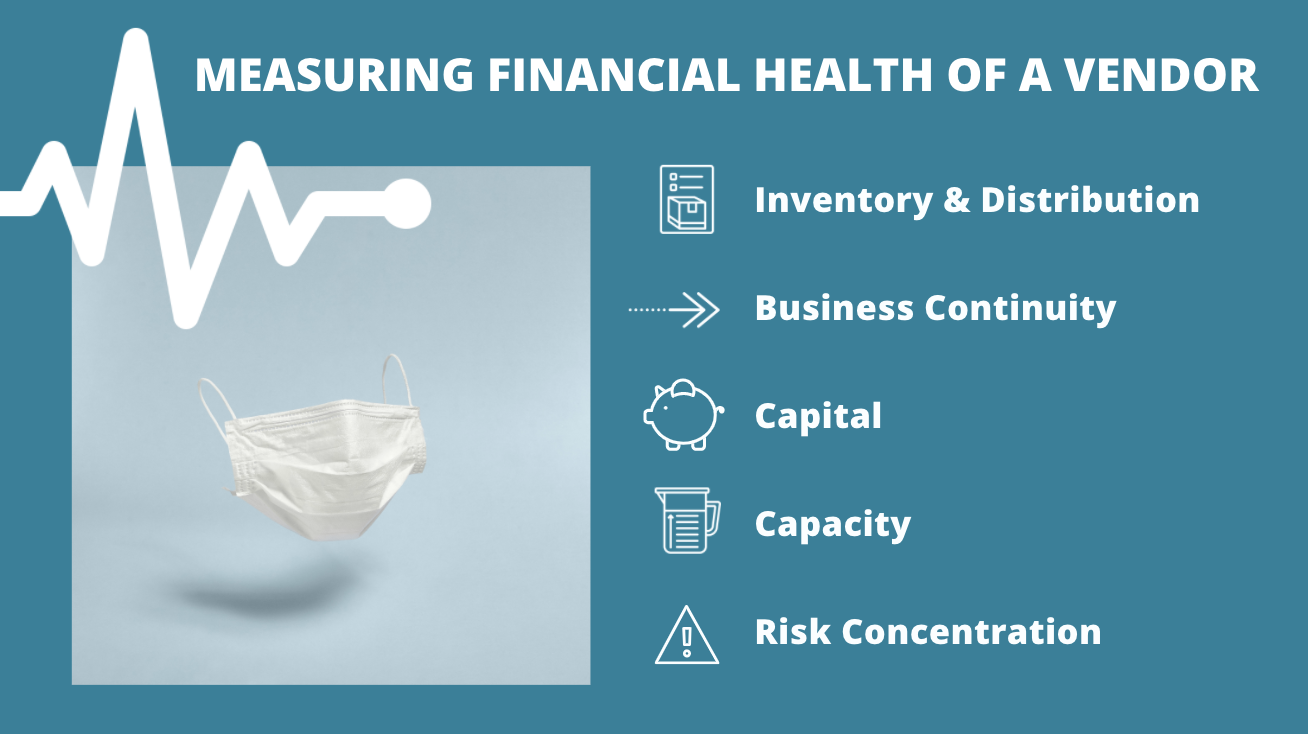

Given wide-spread financial instability, transparency and collaboration with your vendors is key. You must be able to understand how volatility will impact your vendors and your ability to deliver to your customers. Gellert recommends that conversations with your vendors cover these factors to gauge their overall financial health:

Inventory & Distribution

- If you cease operations, how long can you fill orders with inventory on-hand?

- How are you prioritizing customer orders with limited inventory and production capacity?

- With various travel restrictions, do you anticipate issues with shipment or distribution, either to your own customers, or fulfillment from your suppliers?

Business Continuity

- How much of your team has been transitioned to working remotely?

- Are there any areas of your business where your capabilities have changed?

- How long can you sustain operating in contingency mode without adverse impact to your operations?

- Have you developed a specific plan for resuming normal operations after the pandemic subsides?

Capital

- Do you have plans in place to refinance any outstanding short-term debt? Or do you plan to repay in cash?

- Do you have plans to issue any long-term debt (non-bank financing)?

- Is your funding principally from banks, bond market or alternative credit providers?

- Do you have a credit relationship with more than one bank? More than 5?

- Are you in compliance with any loan agreement and/or bond indenture covenants? Do you anticipate any non-compliance in the next 12 months.

- Do you have venture or private equity backing? Is it a minority or control stake?

- Do you intend any equity issuance in the next 12 months?

- Do you intend any asset sales in the next 12 months?

Capacity

- What steps are you taking to increase the likelihood that you can accommodate an increase in demand from your customers?

- Will you be able to meet my projected demand in accordance with existing SLA’s or contract terms?

- Do you have access to contingent labor or another flexible labor source if demand was to increase suddenly?

Risk Concentration

- What percentage of the supplier’s revenue do you represent?

- Is the balance of the supplier’s revenue coming from companies in your industry?

- Is the balance of the supplier’s revenue coming from customers in a concentrated industry and region or diversified industries and regions?

- If concentrated, is your supplier’s revenue coming from an industry and/or region most impacted by the COVID crisis (e.g. airlines, Italy)?

Understanding the above dynamics is extremely important for determining how you are going to work with a company and whether you are doing the right level of diligence in your continuous monitoring.

Financial health remains a key element of every Third Party Risk program and must be continuously examined, not just during initial vendor selection. As we enter a period of tremendous vulnerability and volatility, understanding the financial health of vendors should be implemented as a foundational area in third party risk programs. Think of the financial health of a vendor as a thermometer: financial health is the leading indicator for all other areas of risk.

For more insights on measuring the financial health of your vendors, and especially now in the time of COVID-19, visit RapidRatings’ Resource Center.

For more information on the Shared Assessments Vertical Strategy Groups and Continuous Monitoring Working Group, click here.