Geopolitical ESG Fallout

The geopolitical impact of ESG (environmental, social, and governance) has been out of the spotlight. The recent Russia-Ukraine crisis has changed that reality.

In our recent Russia-Ukraine Conflict: Geopolitical ESG Fallout Webinar panelists explored the short and long-term consequences of significant geopolitical events on ESG strategy and discussed ways for organizations to best navigate those consequences.

Speakers in the webinar included:

- Gary Roboff, Senior Advisor, Shared Assessments

- Andrew Moyad, CEO, Shared Assessments

- Cristina Dolan, Head of Global Alliances, RSA NetWitness

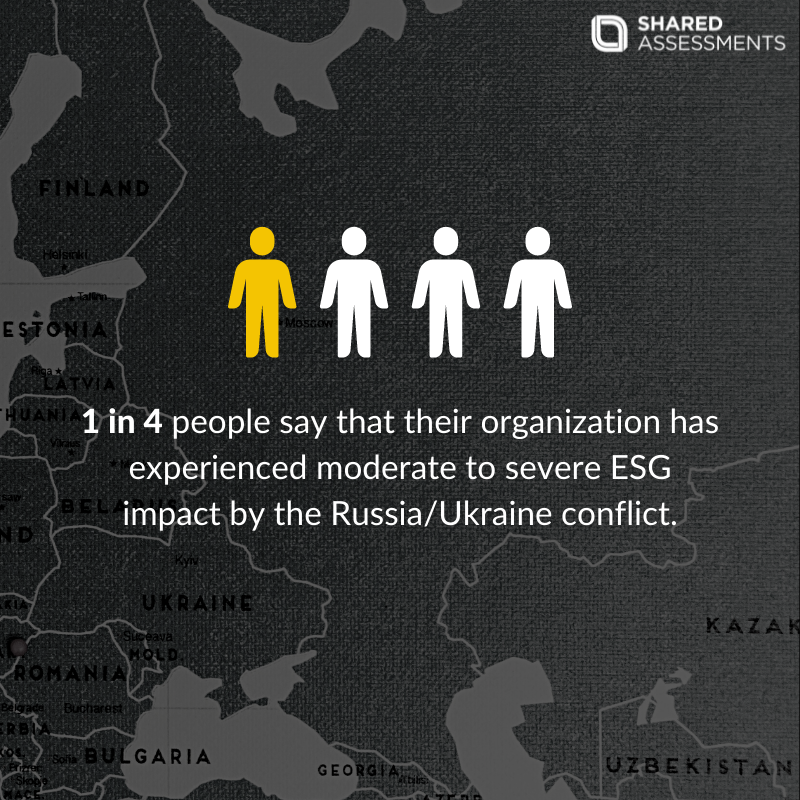

The webinar began with a poll asking attendees if their organizations have had an ESG impact due to the Russian-Ukraine crisis. One in four people said that their organization has experienced moderate to severe ESG impact from the Russia/Ukraine conflict.

What are the impacts on the supply chain because of the Russia-Ukraine crisis?

Following the poll, panelists dived into a discussion regarding the impacts on the supply chain due to the Russia-Ukraine crisis. Christina Dolan shared that oil has had the most significant impact. She said, “material manufacturing will raise the price of everything. We may not necessarily feel the impact of the supply chain changes but we are going to see as the cost gets embedded into products that we buy or shipped to us.”

From a cyber perspective, Gary Roboff added, “if you are a bank, you might be buying products or software that is created in Ukraine as it is a huge source of software, and this has been terribly disruptive.”

Why should we think of cybersecurity as part of ESG and its relevancy to the Russia-Ukraine crisis?

“You hear a lot about the fourth industrial revolution which is coming and that is going to have a massive impact because the movement of economic value is being moved differently through shared and autonomous vehicles. We have new forms of communication with the internet and cryptocurrency – the financial aspect of it,” explained Dolan. She continued “we also have changes in energy and how you power economic value. All of this is made possible through connectivity and network information systems right at the core that by default make us more vulnerable to cybersecurity because everything has a component of data and connectivity. The surface area of these systems is varied, and they have diverse types of vulnerabilities, and it becomes much more difficult to manage that risk.”

What areas of infrastructure should be enhanced?

Gary Roboff emphasized that our electrical grid needs to be enhanced: “The Colonial Pipeline is a notable example when you think about energy and where it comes from. We have a centralized production system, and we have folks that deliver energy to individuals whether it is through a gas pump, gas line to your home, or an oil truck coming to deliver fuel; all of that is at risk.”

Shared Assessments and ESG

Organizations without effective ESG strategies or practices could suffer far worse consequences as ESG concerns continue to grow in light of the global events and conditions. We encourage members of our community to join Shared Assessments ESG TPRM Strategies Group. This group will focus on mature third party risk management sustainability practices in today’s fast-paced ESG arena. This committee seeks participants from all organizations with an ESG third party risk agenda, no matter what level of ESG TPRM experience an entity has under its belt.